what percent is taken out of paycheck for taxes in massachusetts

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437.

Massachusetts Sales Tax Rate Rates Calculator Avalara

How much will I be taxed in Massachusetts.

. A 401k is a financial plan that helps people save for retirement and is provided by an employer. A state excise tax. Jan 01 2020 when massachusetts income tax withheld is 500 or more by the 7th 15th 22nd and last day of a month pay over within 3 business days after that.

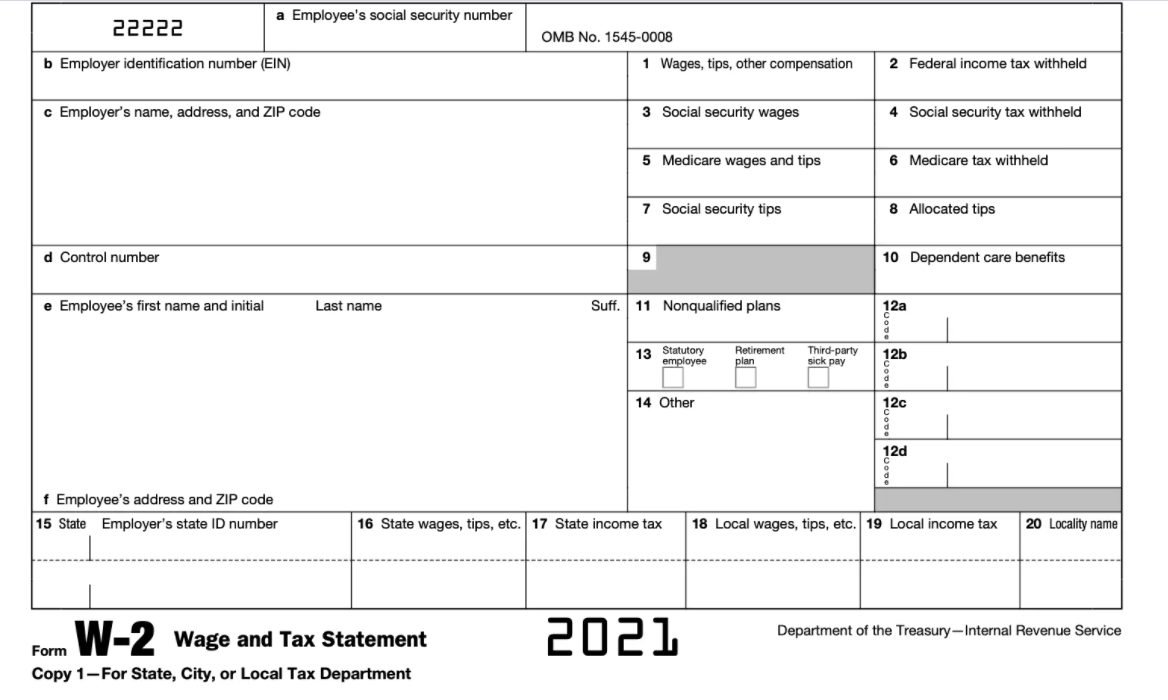

Massachusetts Income Tax Calculator 2021. The amount of federal and Massachusetts income tax withheld for the prior year. A state sales tax.

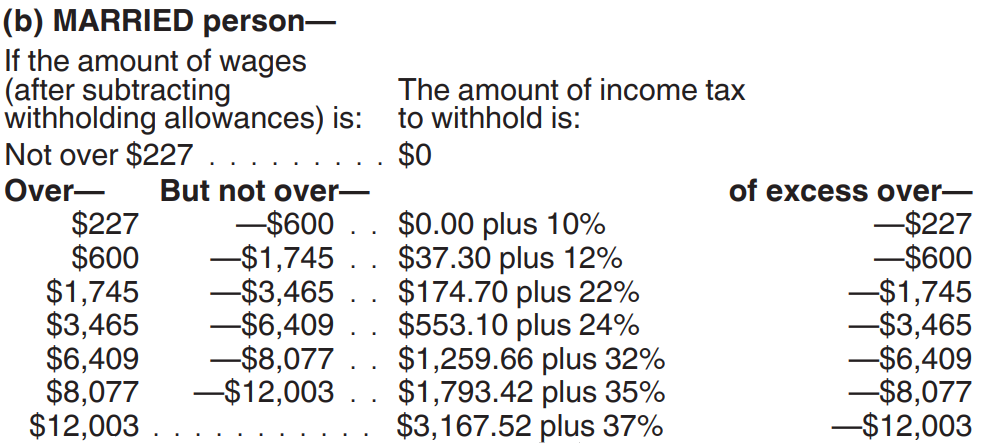

Contacting the Department of. 10 12 22 24 32 35 and 37. There are seven federal tax brackets for the 2021 tax year.

Total income taxes paid. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Just enter the wages tax.

What is the percentage that is taken out of a paycheck. Total income taxes paid. Where Do Americans Get Their Financial Advice.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The total Social Security and Medicare taxes withheld. My pay is 63020 per.

By Benjamin Yates August 15 2022 August 15 2022. Is mass tax exempt. For tax year 2020 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest.

These are the rates for. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. Massachusetts Hourly Paycheck Calculator.

Your bracket depends on your taxable income and filing status. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Use this paycheck calculator to figure out your take-home pay as an hourly employee in Massachusetts.

Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Payroll taxes in Massachusetts. Amount taken out of an average biweekly paycheck.

A local option for cities or towns. Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck. Payroll taxes in Massachusetts It doesnt matter.

The amount of federal and Massachusetts income tax withheld for the prior year. Your average tax rate is 1198 and your. New employers pay 242 and new.

What Percentage Is Taken Out Of My Paycheck In Massachusetts. It allows employees to save and invest some of their pay before taxes are taken. So the tax year 2022 will start from July 01 2021 to June 30 2022.

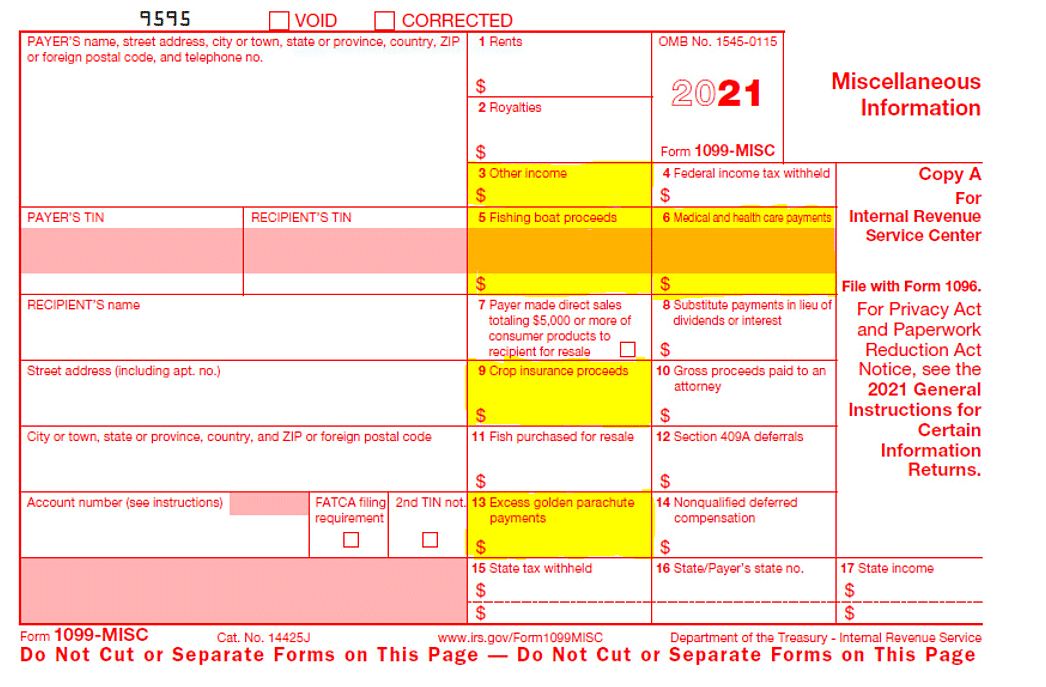

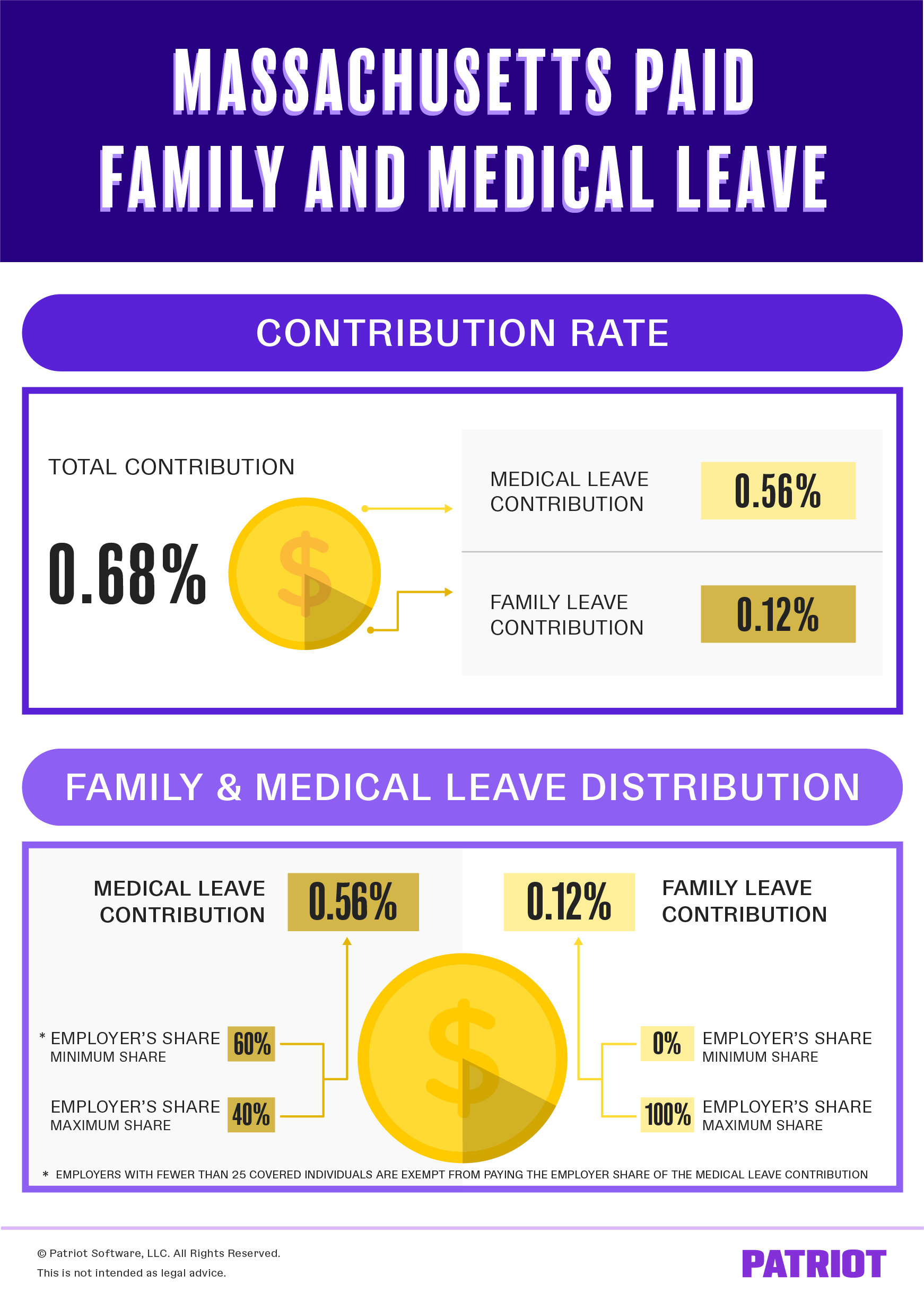

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

![]()

Massachusetts Paycheck Calculator 2022 With Income Tax Brackets Investomatica

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Massachusetts Income Tax Calculator Smartasset

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Live In Nh But Work In Ma What To Know About Your State Tax Returns Milestone Financial Planning

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Massachusetts Paid Family Leave Rates Start Dates More

Free Online Paycheck Calculator Calculate Take Home Pay 2022

The Tax Law For Living In New Hampshire But Working In Massachusetts Sapling

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

How Much Of My Paycheck Goes To Taxes

A Complete Guide To Massachusetts Payroll Taxes

The Complete Guide To Massachusetts Payroll

Where Does All Your Money Go Your Paycheck Explained

Payroll Information For Massachusetts State Employees Office Of The Comptroller